Don’t worry about coming off as pushy-you are the professional and your customers understand you need to be paid. Set definite payment deadlines – if your invoices aren’t to be paid immediately, you should spell out a clear due date for your customers.

#Invoice example pro

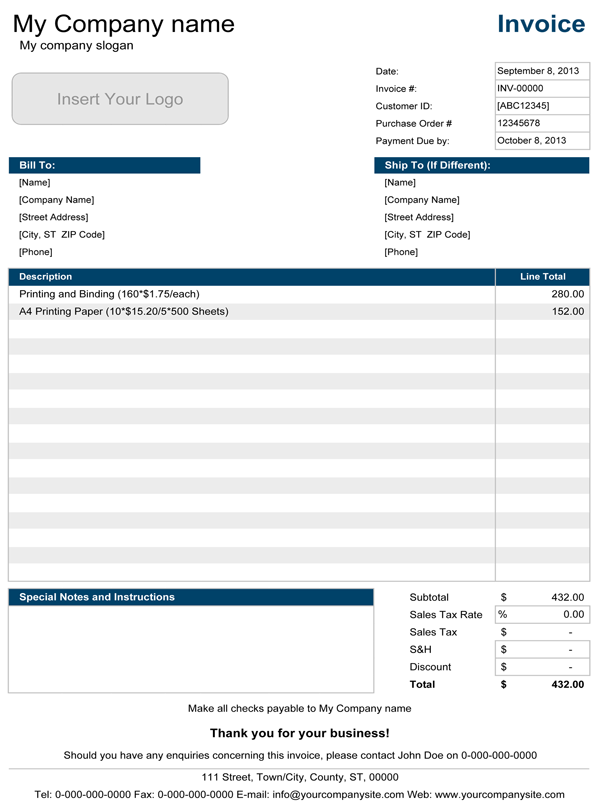

Here are some pro tips from Sage on the best invoicing practices to please your customers and ensure prompt payment. Proper invoicing practice is integral to success. That said, most customers understand that immediate cash flow is essential to keeping smaller operations running smoothly. Most small companies or individuals would do well to use their size as an asset, as they’re able to provide more attentive service to their customers than the big companies. Having your invoice due upon receipt is a perfectly acceptable practice as well. Small businesses or individuals often adopt this policy to project that established professionalism to their customers. For larger companies, cash flow may be calculated by monthly goals, so getting paid immediately or two weeks later is relatively inconsequential. Invoicing at the end of the engagement has a certain professionalism to it and gives off the sense that the business is established. having the invoice paid as soon as the transaction is complete. Generally speaking, larger companies will send an invoice at the end of the customer engagement while smaller companies or individuals practice the “due upon receipt” policy, i.e. When it comes to sending invoices to clients, it’s important to take into consideration your customer base, as well as the image you’d like to project. If you’re providing a service, you may want to leave some space for notes and future recommendations regarding that service. If you’re using this basic invoice form as a bill of sale, you may want to itemize the products sold-this helps you keep track of inventory and is something the customer will certainly want to see on an invoice.

0 kommentar(er)

0 kommentar(er)